- March 13, 2024

- ubaidah khan

- 0

Easypaisa, Pakistan’s premier digital payment system, provides a straightforward way to manage finances via its mobile wallet. Users can access a variety of services, including bill payments, money transfers, and mobile loads. However, as with any financial service, Easypaisa accounts have transaction limits. This article will explain how to increase your Easypaisa account limit. Increasing these restrictions may improve your convenience and financial flexibility. Here’s a step-by-step instruction for doing it precisely.

Understand your current limit

First and foremost, you must know your Easypaisa account’s current limit. Easypaisa offers a variety of account levels, each with its own set of transaction and amount limits. These limits are intended to ensure security and compliance with regulatory standards. By following the procedures outlined here, you will discover how to increase your Easypaisa account limit.

Step 1: Upgrade your account type

Mobile Account Registration: Initially, your transaction limits are set by your account type: Mobile Account (Basic) or Mobile Account (Level 1). If you want to increase your limit, consider upgrading to a higher-level account.

Documentation: When upgrading your account, you may be required to provide extra evidence for verification. This may include your CNIC (Computerized National Identity Card), proof of address, or other pertinent documents.

Step 2: Apply limit enhancement

Visit a serviccentreer or retailer: You can request a limit increase by visiting an Easypaisa Service Centre or a Telenor franchise. Retailers can also help in this process.

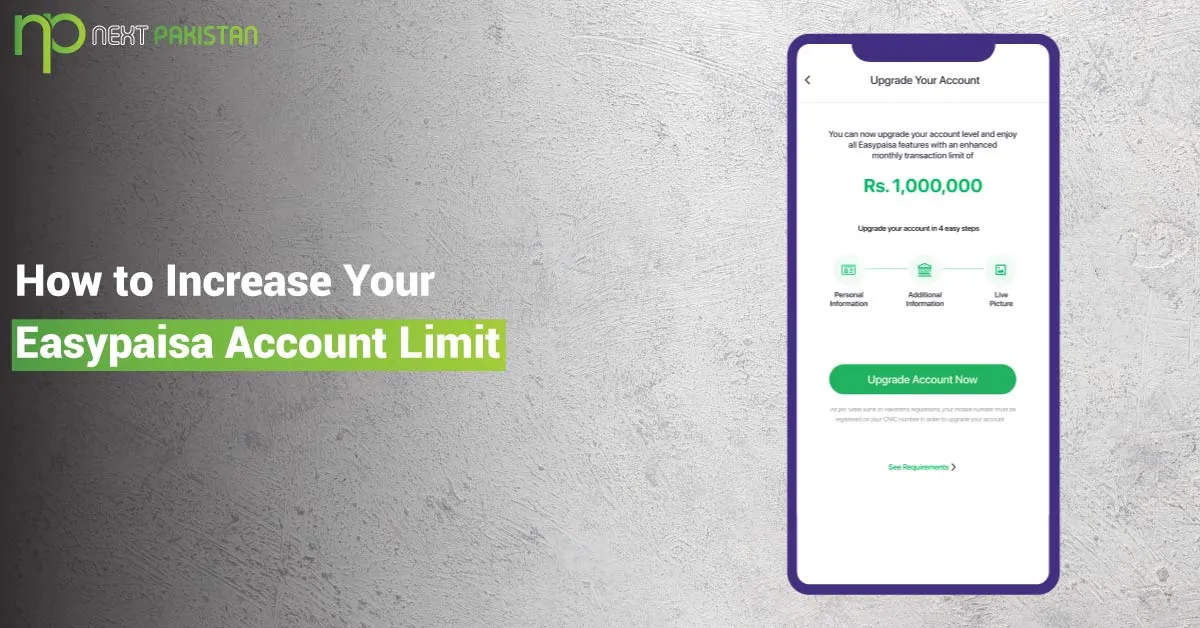

Use the Easypaisa app: Alternatively, the Easypaisa mobile app may have choices for requesting an account upgrade or limit enhancement directly from the app.

Step 3: Provide necessary documentation

Verification Process: Whether you apply through a service centre or the app, you must supply the required evidence for verification. This method is critical for meeting banking requirements and guaranteeing the security of your transactions.

Step 4: Wait for Approval. Processing time:

After submitting your application and papers, there will be a processing time.

Step 5: Confirmation and notification of limit increase.

When your application is granted, you will receive a notification, typically by SMS or email, confirming the increase in your transaction limit. Increasing your Easypaisa limit can help you execute larger transactions and manage your funds more effectively. You may get the most out of your Easypaisa account if you follow these steps and meet all of the requirements.

Finally, increasing your Easypaisa account limit provides greater financial flexibility and transactional freedom. The process, which includes account upgrades and verification, is simple but needs attention to detail and respect for rules and regulations. Always verify the authenticity of the provided information and emphasize account security, especially with greater transaction limits. Following these steps will allow you to easily enhance your digital financial skills, making it easier and more efficient to handle your money with Easypaisa.